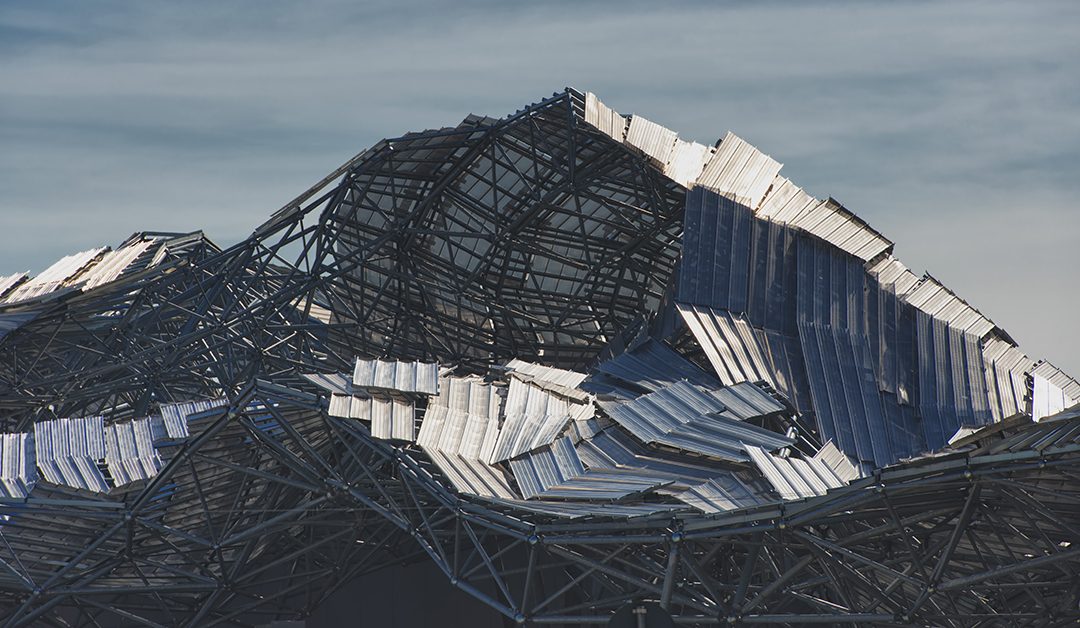

After a disaster has passed, leaving behind a huge mess, it’s hard to know where to begin putting things right. Resist the temptation to run away and worry about it later! It’s time to file a disaster claim!

Your mission is to call your insurers and get the claim ball rolling. The sooner you report damage, the sooner you get to cash the check. Here are our top five tips for navigating an insurance claim when you’ve been through a disaster.

- Call the Disaster Relief Company First

Benefits of calling the disaster relief team first include the ability to assess the damage and decide if you should go through the insurance, and the peace of mind you get from having a connection that will be with you every step of the way.

However, the most important benefit is that you can avoid blindly choosing the insurance company’s ‘preferred provider’ and instead choose the company that YOU think will best represent your interests. There are many potential problems with choosing the preferred provider, all stemming from the fact that they too work for the insurance company. Do your research, make a wise choice, and call your disaster relief company first.

- Begin Processing Your Disaster Right Away

When you experience a disaster, you may be tempted to step away from the situation for a while to avoid the stress. However, you must act right away to prevent further damage and to avoid the risk of your insurance company not covering the claim.

A good disaster relief company should provide speedy services. Some companies are available 24/7 and aims to be at your home within 90 minutes (depending on travel distance and time). If you call right away you can get to the next step – calling the insurance company – within hours.

- Evidence Is Key

The key to winning the most in your insurance claim is the evidence you provide. The right evidence will allow you to provide proof of the source of the damage, the extent of the damage, and the cost of repairs. Once again, you want an experienced team who knows how to document evidence of your disaster. The most valuable evidence is pictures. You can never have enough pictures, and companies like Toledo Roof Repair understand the importance of documenting the entire cleanup process with pictures the insurance company is looking for.

- Be Aggressive.

You can’t be passive when dealing with insurance issues. The insurance company is looking out for their best interests, trying to offer you the lowest amount possible for your claim. When dealing with insurance, you want a disaster relief company who can act aggressively and be your advocate. The insurance company is looking out for their best interests – who’s looking out for yours? It should be an experienced disaster relief company that you can trust to gather the necessary evidence and defend your claims.

- Be Patient.

Dealing with insurance is a game of ‘hurry up and wait.’ It can be a long and frustrating process, but you have to follow all the steps and remain patient if you want the best possible results. Your disaster relief team should keep you updated every step of the way, but your patience is also important to the process.

If you’ve experienced a disaster, contact Toledo Roof Repair! When it comes to your roofing services, Toledo Roof Repair is the best choice for top quality work and fair prices.